Single Family Home For Sale in Oakland, NJ

MLS# : 25011958

PROPERTY DETAILS

PROPERTY DESCRIPTION

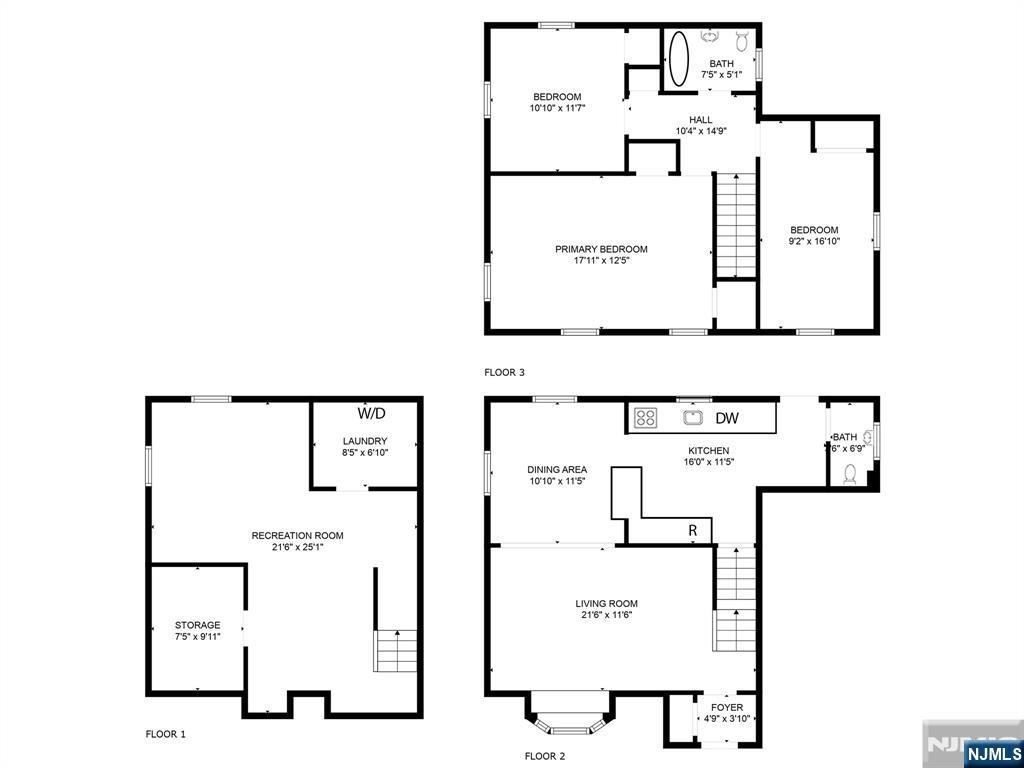

For more information on this home please contact Kim Damion- 240-620-5811. Discover pride of ownership in this impeccable Colonial located in Oakland’s sought-after Manito section. A double-door entry opens to a sun-filled living room with gleaming hardwood floors. The formal dining room with crown molding flows into a chef-inspired kitchen featuring custom cabinets, granite counters, tile backsplash, and stainless steel appliances. Step out from the breakfast area to a large Trex deck overlooking a serene 200-foot-deep backyard. Upstairs offers two generous bedrooms, a full bath, and a spacious primary suite. The finished basement includes a rec room, laundry, and utility area. All this in Oakland, a Silver Level Sustainability Town.

Amenities

Close/Trans

This listing is a courtesy of RE/MAX SELECT - Oakland

201-337-5555 office, listing agent Thomas Russo

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)

About Oakland, NJ Real Estate Market

Since there are a lot of white oak trees in the territory of the borough, it got its name Oakland (the land of oak trees). There is a section in the borough of Oakland, in which the streets are named after the Native American first names and tribes.

The start of New Jersey real estate in Oakland began with the construction of Van Allen House in 1748, which served as a stop for George Washington and his troops in 1977. Another summer bungalow colony was developed in a valley on the Ramapo River between the 1940s and 1960s, which is currently serving as second homes for families from New York and urban New Jersey to escape from the brunt of summer heat.

| Population: | 12,754 |

| Total Housing Units: | 4,470 |

| Single Family Homes: | 4,410 |

| General Tax Rate (2023): | 2.374% |

| Effective Tax Rate (2023): | 2.164% |

| Compare To Other Towns |

Oakland Market Indicators

Similar Listings in Oakland

The data relating to the real estate for sale on this web site comes in part from the Internet Data Exchange Program of the NJMLS. Real estate listings held by brokerage firms other than Madison Adams are marked with the Internet Data Exchange logo and information about them includes the name of the listing brokers. Some properties listed with the participating brokers do not appear on this website at the request of the seller. Listings of brokers that do not participate in Internet Data Exchange do not appear on this website.

NJMLS is the owner of the copyrights of the listing content displayed for IDX. The NJMLS Internet Data Exchange Logo is a service mark owned by the NJMLS, Inc.

All information deemed reliable but not guaranteed. Last date updated: 05/01/2025 00:05 AM

Source: New Jersey Multiple Listing Service, Inc.

“©2025 New Jersey Multiple Listing Service, Inc. All rights reserved.”

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to compute the tax bill.

Effective Tax Rate is used to compare of one district to another district based on the assumption that all districts are at 100% valuation. This rate has been computed by the State of New Jersey Department of the Treasury using County Equalization Average Ratios. This rate is NOT to be used to compute the tax bill.

Data Source: US Census 2010, NJ MLS, State of New Jersey Department of the Treasury