Condo For Sale in Rutherford, NJ

MLS# : 25016557

PROPERTY DETAILS

PROPERTY DESCRIPTION

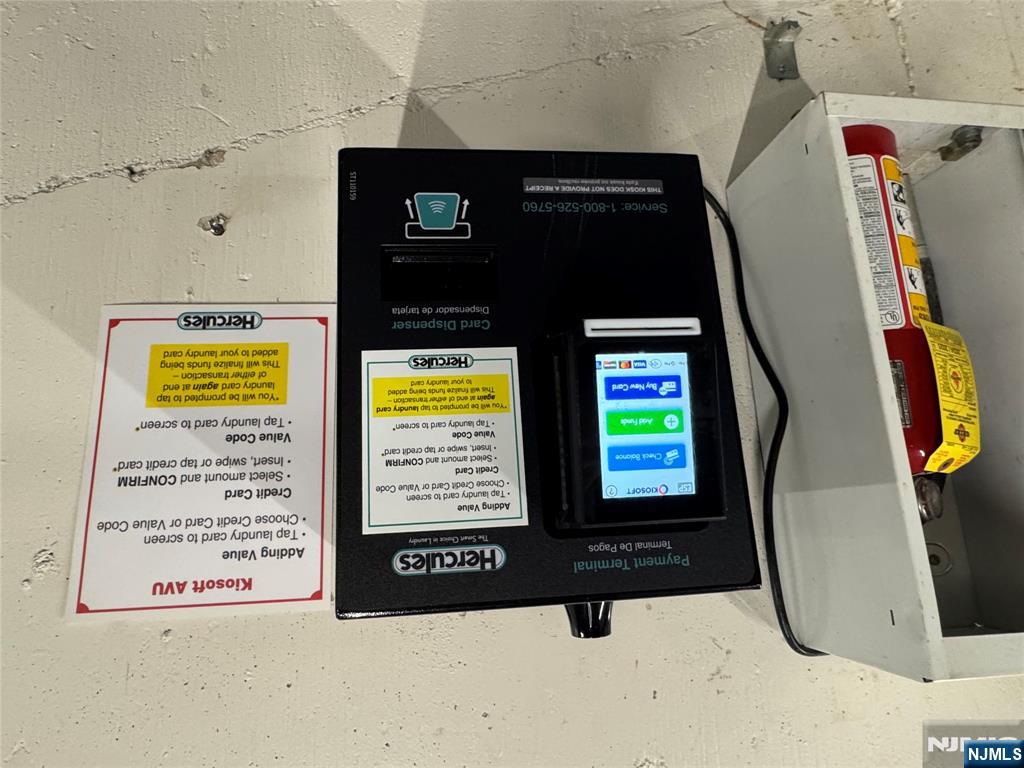

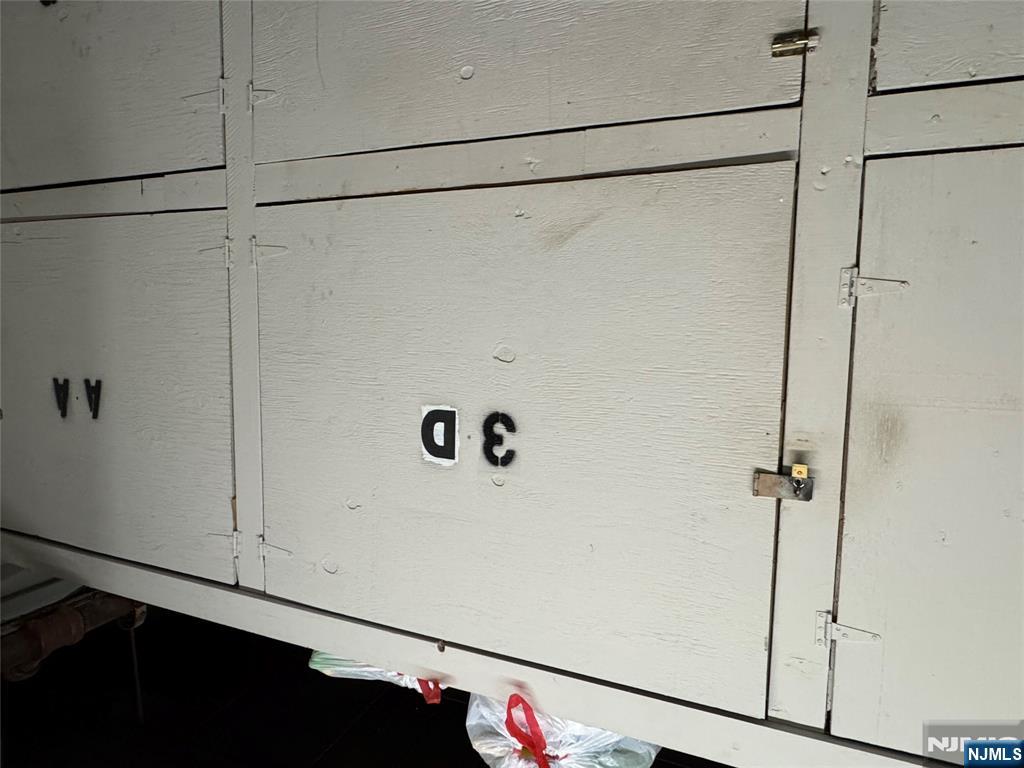

WELCOME TO THIS BRIGHT ONE BEDROOM CONDO UNIT LOCATED IN THE HEART OF RUTHERFORD, FEW STEPS FROM NJ TRANSIT AND NYC TRAIN STATION. THIS BEAUTIFULLY DONE CONDO ON THE THIRD FLOOR OFFERS OPEN CONCEPT WITH NEW KITCHEN STAINLESS STEEL APPLIANCES AND QUARTZ COUNTERTOPS, FOLLOWED BY SPACIOUS LIVING ROOM OPEN DINING AREA AND NICELY DONE BATHROOM.UNIT COMES WITH ASIGNED STORAGE BIN IN BSMT AND PARKING SPACE ALSO THERE IS BIKE STORAGE AND LAUNDRY IN BASEMENT. LOCATED WITHIN CLOSE PROXIMITY TO DOWNTOWN RUTHERFORD, SCHOOLS PARKS AND HIGHWAYS THIS UNIT SERVES AS COMMUTERS DREAM.

Amenities

- Elevator

Dishwasher, Microwave, Ov/Rng/Ele, Refrigerator

Life Style :Close/Parks, Close/School, Close/Shopg, Close/Trans, One Floor Living

This listing is a courtesy of Roselli Realty, LLC

973-928-1932 office, listing agent Faruk Xhemajlaj

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)

About Rutherford, NJ Real Estate Market

Rutherford downtown area is full of fine dining restaurants, high-end salons, art studios, fitness centers, a town museum, newly renovated library, parks and many more attractions. Rutherford is also home to Felician University and their well-known nursing program.

Many homeowners are attracted to this vibrant community and the highly rated schools that have been awarded the “Blue Ribbon Schools of Excellence” status.

| Population: | 18,061 |

| Total Housing Units: | 7,278 |

| Single Family Homes: | 5,014 |

| General Tax Rate (2023): | 3.041% |

| Effective Tax Rate (2023): | 2.256% |

| Compare To Other Towns |

Rutherford Market Indicators

Similar Listings in Rutherford

The data relating to the real estate for sale on this web site comes in part from the Internet Data Exchange Program of the NJMLS. Real estate listings held by brokerage firms other than Madison Adams are marked with the Internet Data Exchange logo and information about them includes the name of the listing brokers. Some properties listed with the participating brokers do not appear on this website at the request of the seller. Listings of brokers that do not participate in Internet Data Exchange do not appear on this website.

NJMLS is the owner of the copyrights of the listing content displayed for IDX. The NJMLS Internet Data Exchange Logo is a service mark owned by the NJMLS, Inc.

All information deemed reliable but not guaranteed. Last date updated: 05/25/2025 00:05 AM

Source: New Jersey Multiple Listing Service, Inc.

“©2025 New Jersey Multiple Listing Service, Inc. All rights reserved.”

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to compute the tax bill.

Effective Tax Rate is used to compare of one district to another district based on the assumption that all districts are at 100% valuation. This rate has been computed by the State of New Jersey Department of the Treasury using County Equalization Average Ratios. This rate is NOT to be used to compute the tax bill.

Data Source: US Census 2010, NJ MLS, State of New Jersey Department of the Treasury