Commercial space For Lease in Cresskill, NJ

MLS# : 25022240

PROPERTY DETAILS

PROPERTY DESCRIPTION

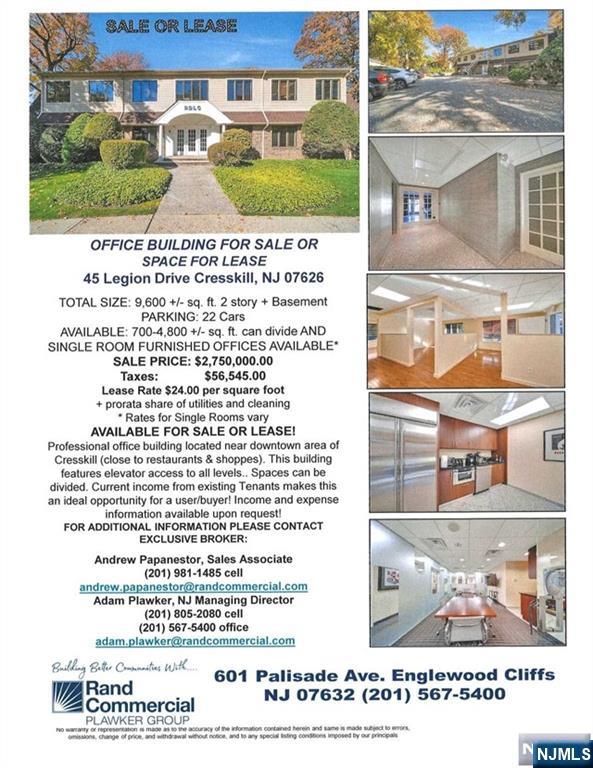

Prime professional building in the center of Cresskill business district, offering elevator access and ample parking. Ideal for office, medical, and similar professional use Currently asking $28.50 per sq ft + $2.00 per sq ft (electricity) Available spaces are from 540 sq ft - 1690 sq ft. 1st Fl | Unit 100 | 1,047 sq ft, 1st Fl | Unit 110 | 1,690 sq ft, 1st Fl | Unit 130 | 1,200 sq ft, 1st Fl | Unit 150 | 540 sq ft, 2nd Fl | Unit 220 | 1,100 sq ft, 2nd Fl |

Amenities

This listing is a courtesy of Christie's International Real Estate Group-Fort Lee

201-346-0200 office, listing agent Sara Shin

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)

About Cresskill, NJ Real Estate Market

According to the 2010 United States Census, the town population was 8,573. The name ‘Cresskill’ originates from the watercress that grew in the town’s kills, a Dutch word for a stream.

During the World War I, Cresskill was a military base known as Camp Merritt and the debarkation point for more than a million American troops who were sent abroad to fight against the Germans. The military base was decommissioned in 1919 and in 1924 a large monument was dedicated to remember and honor those who were stationed at Camp Merritt.

Town amenities include many points of interest, places of worship and recreational facilities such as the Cresskill Municipal Swim Club and the Cresskill Community Center.

| Population: | 8,573 |

| Total Housing Units: | 3,114 |

| Single Family Homes: | 2,723 |

| General Tax Rate (2023): | 2.320% |

| Effective Tax Rate (2023): | 1.832% |

| Compare To Other Towns |

Cresskill Market Indicators

PRICE INDEX

| Average Price* (12mo): | $1,256,557 |

| Homes Sold* (12mo): | 97 |

Similar Listings in Cresskill

The data relating to the real estate for sale on this web site comes in part from the Internet Data Exchange Program of the NJMLS. Real estate listings held by brokerage firms other than Madison Adams are marked with the Internet Data Exchange logo and information about them includes the name of the listing brokers. Some properties listed with the participating brokers do not appear on this website at the request of the seller. Listings of brokers that do not participate in Internet Data Exchange do not appear on this website.

NJMLS is the owner of the copyrights of the listing content displayed for IDX. The NJMLS Internet Data Exchange Logo is a service mark owned by the NJMLS, Inc.

All information deemed reliable but not guaranteed. Last date updated: 07/08/2025 00:05 AM

Source: New Jersey Multiple Listing Service, Inc.

“©2025 New Jersey Multiple Listing Service, Inc. All rights reserved.”

General Tax Rate is used to determine the amount of real estate tax levied upon a particular property. This rate is used to compute the tax bill.

Effective Tax Rate is used to compare of one district to another district based on the assumption that all districts are at 100% valuation. This rate has been computed by the State of New Jersey Department of the Treasury using County Equalization Average Ratios. This rate is NOT to be used to compute the tax bill.

Data Source: US Census 2010, NJ MLS, State of New Jersey Department of the Treasury